Wealth maximization vs profit maximization

difference between wealth maximization and profit maximization

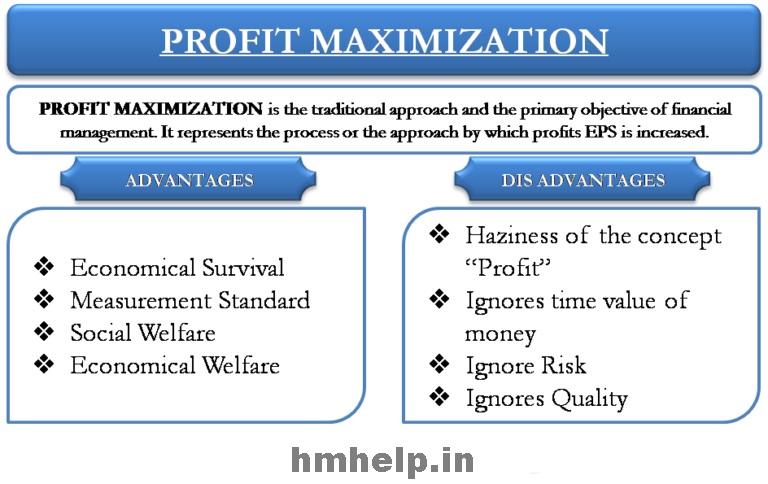

Profit Maximization (Traditional Approach)

Profit maximization is the main aim of any business and therefore it is also an objective of financial management. Profit maximization, in financial management, represents the process or the approach by which profits Earning Per Share (EPS) is increased. In simple words, all the decisions whether investment or financing etc. are focused on maximizing the profits to optimum levels.

Wealth maximization (Modern Approach)

Modern Approach is about the idea of wealth maximization that removes all the limitations of the profit maximization objective. Wealth maximization involves increasing the Earning per share of the shareholders and to maximize the net present worth. Wealth means net present worth which is the difference between gross present worth of some decision or course of action (capitalized value of the expected cash benefits) and the investment required to achieve these benefits(original cost).

The Wealth Maximization approach is concerned with the amount of cash flow

generated by a course of action rather than the profits. Any course of action that has net present worth above zero creates wealth should be selected. The goals of financial management may be such that they should be beneficial to owners, management, employees and customers. These goals may be achieved only by maximizing the value of the firm.

Profit Maximization vs. Wealth Maximization Objective:

Maximization of economic welfare of the owners should be the main or primary financial objective of any business enterprise. This maximization of economic welfare of the owners should be achieved through profit maximization or through wealth maximization is a matter of question.

Profit Maximization Objective:

Profit maximization means maximizing the profit to be earned by a company in a given time period. The term ‘profit’ can be used in two senses viz. (1) Profit as the owner oriented concept and (2) Profit as the operational concept.

Profit as the owner oriented concept means the amount of dividend that goes to the shareholders in the form of dividend. Whereas, profit as the operational concept denotes the profitability which is an indicator of the operational efficiency of a company.

Profit maximization is a traditional approach of financial management. Earlier the sole objective of a company was to earn more and more profit only and the finance manager was taking all the financial decisions in the light of this objective only.

Therefore, according to this criterion, the financial decisions of a firm should be profit maximization oriented (i.e. select those assets, projects and decisions which are profitable and reject those which are not profitable). In other words, decisions which increase the company’s profit are to be undertaken and those which decrease its profit are to be avoided.

The major drawbacks or limitations of the profit maximization objective are as follows:

- The term ‘profit’ is vague i.e. is not clear.

- It ignores the time factor i.e. whether it is a long term profit or a short term profit.

- The term ‘maximum’ is also not clear.

- It ignores the time value of money.

- It ignores risks to be involved in maximizing profit i.e. financial and business risks.

- It ignores social responsibilities of a business.

Wealth Maximization Objective:

The profit maximization objective is not only vague and ambiguous, but also it ignores the two most important factors i.e. risk factor and time value of money while taking financial decisions of an enterprise.

Therefore, a new basic objective of financial management called ‘wealth maximization objective’ was introduced to replace the profit maximization objective. This new objective of financial management removes all the serious limitations of the profit maximization objective.

According to Ezra Soloman of Stanford University, USA, the ultimate objective of financial management should be the maximization of wealth of a business enterprise. Prof. Irwin, his friendhas also supported this view. Now all the financial decisions are taken by the finance manager of a business enterprise in the light of ‘wealth maximization’ only.

Wealth Maximization means maximizing the wealth or value of a business enterprise. It is also known as ‘Value Maximization’ or ‘Net Present Value Maximization’. Wealth means the ‘Net Present Value (NPV)’ of a course of action or of a financial decision that is to be undertaken by an enterprise.

TheNPV of a course of action or decision is the difference between the total presentvalue of all expected cash benefits to be received in future and the amount of initial investment required to achievethose benefits. The present value of the expected cash benefits are calculated bydiscounting the cash flows at a rate of interest which reflects their timings anduncertainty. Thus,

NPV or Wealth = PV of all expected Cash Benefits – Initial Investment

From the above discussion, it can be concluded that profit maximization objective is inappropriate and unsuitable for taking fruitful financial decisions of an enterprise. On the other hand, the wealth maximization objective is considered as the most suitable, appropriate, precise, clear-cut and operationally feasible objective. All the financial decisions of a business enterprise should be taken in the light of wealth maximization only.

Therefore, wealth maximization objective is superior to the profit maximization objective.

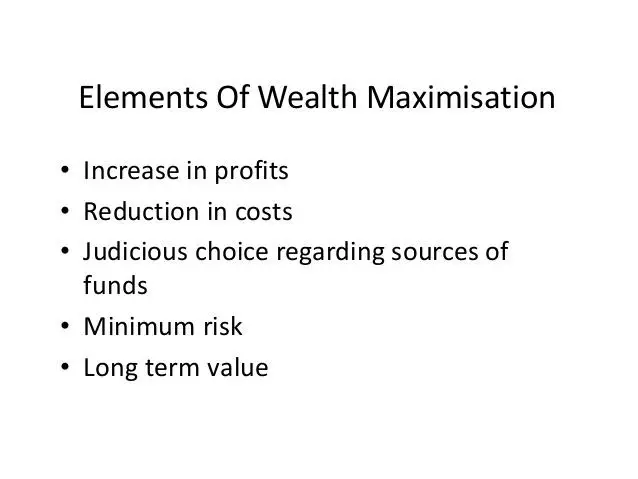

Elements of Wealth Maximization:

The elements involved in wealth maximization of a firm are as follows:

- Increase in Profits

- A firm should increase its revenues in order to maximize its value. For this purpose, the volume of sales or any other activities should be stepped up. It is a normal practice for a firm to formulate and implement all possible plans of expansion and take every opportunity to maximize its profits. In theory, profit are maximized when a firm is in equilibrium. At this stage, the average cost is

- minimum and the marginal cost and marginal revenue are equal. A word of caution, however, should be sounded here. An increase in sales will not necessarily result in a rise in profits unless there is a market for increased supply of goods and unless overhead costs are properly controlled.

- Reduction in Cost

- Capital and equity funds are factor inputs in production. A firm has to make every effort to reduce cost of capital and launch economy drive in all its operations.

- Sources of Funds

- A firm has to make a judicious choice of funds so that they maximize its value. The sources of funds are not risk-free. A firm will have to assess risks involved in each source of funds. While issuing equity stock, it will have to increase ownership funds into the corporation. While issuing debentures and preferred stock, it will have to accept fixed and recurring obligations. The advantages of leverage, too, will have to be weighed properly.

- Minimum Risks

- Different types of risks confront a firm. “No risk, no gain” – is a common adage. However, in the world of business uncertainties, a corporate manager will have to calculate business risks, financial risks or any other risk that may work to the disadvantage of the firm before embarking on any particular course of action. While keeping the goal of maximization of the value of the firm, the management

- will have to consider the interest of pure or equity stockholders as the central focus of financial policies.

- 5. Long-run Value

The goal of financial management should be to maximize long run value of the firm. It may be worthwhile for a firm to maximize profits by pricing its products high, or by pushing an inferior quality into the market, or by ignoring interests

of employees, or, to be precise, by resorting to cheap and “get-rich- quick” methods. Such tactics, however, are bound to affect the prospects of a firm rather adversely over a period of time. For permanent progress and sound reputation, it will have to adopt an approach which is consistent with the goals of financial management in the long-run.

Advantages of Wealth Maximization:

» Wealth maximization is a clear term. Here, the present value of cash flow is taken into consideration. The net effect of investment and benefits can be measured clearly (i.e. quantitatively).

» It considers the concept of time value of money. The present values of cash inflows and outflows help the management to achieve the overall objectives of a company.

» The concept of wealth maximization is universally accepted, because, it takes care of interests of financial institution, owners, employees and society at large.

» Wealth maximization guides the management in framing consistent strong dividend policy, to earn maximum returns to the equity holders.

» The concept of wealth maximization considers the impact of risk factor, while calculating the Net Present Value at a particular discount rate; adjustment is made to cover the risk that is associated with the investments.

Criticisms of Wealth Maximization:

Disadvantage of Wealth Maximization

» The objective of wealth maximization is not descriptive. The concept of

increasing the wealth of the stockholders differs from one business entity

to another. It also leads to confusion in and misinterpretation of financial

policy because different yardsticks may be used by different interests in acompany.

Limitations of Profit Maximization as an objective of Financial Management

The haziness of the concept “Profit” The term “Profit” is a vague term. It is because different mindset will have a different perception of profit. For e.g. profits can be the net profit, gross profit, before tax profit, profit per share or the rate of profit etc. There is no clearly defined profit maximization rule about the profits.

Ignores Time Value of Money – The profit maximization formula simply suggests “higher the profit better is the proposal”. In essence, it is considering the naked profits without considering the timing of them. Another important dictum of finance says “a dollar today is not equal to a dollar a year later”. So, the time value of money is completely ignored. Alternatively we can say that it ignores timing pattern of cash flow.

Ignores the Risk -A decision solely based on profit maximization model would take a decision in favor of profits. In the pursuit of profits, the risk involved is ignored which may prove unaffordable at times simply because higher risks directly questions the survival of a business. Between project A and B, project A may be more profitable however if it is substantially more riskier than project B may be preferable.

Ignores Quality- The most problematic aspect of profit maximization as an objective is that it ignores the intangible benefits such as quality, image, technological advancements etc. The contribution of intangible assets in generating value for a business is not worth ignoring. They indirectly create assets for the organization.

Also Check : NCHM Solved Paper 2014-2015 | Financial Management

mexican pharmaceuticals online: Online Pharmacies in Mexico – mexico pharmacies prescription drugs

п»їlegitimate online pharmacies india https://indiaph24.store/# reputable indian online pharmacy

mail order pharmacy india