What is Funds Flow Statement: Meaning & How to Prepare

Funds Flow Statement is a statement prepared to analyse the reasons for changes in the Financial Position of a Company between 2 Balance Sheets. It shows the inflow and outflow of funds i.e. Sources and Applications of funds for a particular period.

In other words, a Funds Flow Statement is prepared to explain the changes in the Working Capital Position of a Company.

There are 2 types of Inflows of Funds:-

- Long Term Funds raised by Issue of Shares, Debentures or Sale of Fixed Assets

- Funds generated from Operations

If the Long Term Fund requirements of a company are met just out of the Long Term Sources of Funds, then the whole fund generated from operations will be represented by an increase in Working Capital.

However, if the Funds generated from operations are not sufficient to bridge a gap of Long-Term Fund Requirements, then there will be a decline in Working Capital.

Difference between Funds Flow Statement & Cash Flow Statement

Both Funds flow statement and Cash Flow Statement are used in the analysis of part transactions of a business firm. However, there are some differences between the two as given below:-

- Funds Flow Statement is based on the Accrual System of Accounting. However, in case of Cash Flow Statement – only the transactions effecting Cash or Cash equivalents are taken into consideration

- Funds Flow Statement analyses the Sources and Application of Funds of Long Term nature and the Net Increase or Decrease in Long Term Funds will be reflected on the Working Capital of the firm. The Cash Flow Statement only considers the Increase or Decrease in Current Assets or Current Liabilities in calculating the Cash Flow of Funds from Operations

- Funds Flow Statement is more useful for Long-Term Financial Planning. Cash Flow Analysis is more useful for identifying and correcting the liquidity problems of the firm.

- Funds Flow Statement tallies the funds generated from various sources with various uses to which they are put. Cash Flow Statement starts with the Opening Balance of Cash and reaches to the Closing Balance of Cash.

Funds flow statement format

Benefits of Funds Flow Statement

Funds Flow Statement is useful for Long Term Analysis. It is a very useful tool in the hands of the management for judging the financial and operating performance of the Company. The Balance Sheet and the Profit and Loss A/c (Income Statement) fail to provide the information which is provided by the Funds Flow Statement i.e. Changes in Financial Position of an enterprise. Such an analysis is of great help to the management, shareholders, creditors etc

1. The Funds Flow Statement helps in answering the following questions:-

- Where have the profits gone?

- Why is there an imbalance existing between liquidity position and profitability position of an enterprise?

- Why is the concern financially solid in spite of losses?

2. The Funds Flow Statement analysis helps the management to test whether the working capital has been effectively used or not and the working capital level is adequate or inadequate for the requirements of the business. The Working Capital Position helps the management in taking policy decisions regarding payment of dividend etc.

3. The Funds Flow Statement Analysis helps the investors to decide whether the company has managed the funds properly. It also indicates the Credit Worthiness of a company which helps the lenders to decide whether to lend money to the company or not. It helps the management to take policy decisions and to decide about the financing policies and Capital Expenditure for the future.

PREPARATION OF FUNDS FLOW STATEMENT

Step I: Prepare Statement of Changes in Working Capital

For preparing the Funds Flow Statement, the first step is to prepare the Statement of Changes in Working Capital. There may be several reasons for changes in the Working Capital Position of a Company, some of which have been discussed below:-

- Purchase of Fixed Assets or Long Term Investments without raising Long Term Funds

- Payments of Dividends in excess of the Profits earned

- Extension of Credit to the Customers

- Repayment of a Long Term Liability or Redemption of Preference Shares without raising Long Term Resources

Eg: From the Balance Sheet of X Ltd for the year ending 2010 and 2011, prepare Statement of Changes in Working Capital

| Particulars | 2010 | 2011 | Change in Working Capital |

| Current Assets | |||

| Inventory | 1524 | 1491 | -33 |

| Sundry Debtors | 126 | 183 | +57 |

| Cash and Bank | 134 | 166 | +32 |

| Other Current Assets | 8 | 9 | +1 |

| Loans and Advances | 1176 | 1474 | +298 |

| 2968 | 3323 | +355 | |

| (Less) Current Liabilities | |||

| Liabilities | 1776 | 1483 | -293 |

| Provision for Tax | 622 | 745 | +123 |

| Proposed Dividend | 65 | 207 | +142 |

| 2463 | 2435 | -28 | |

| Working Capital | 505 | 888 | 383 |

Step II: Prepare Funds from Operations

The next Step is to prepare the Funds generated only from the Operating Activities of the Business and not from the Investing/Financing Activities of the business. The Funds from Operations shall be prepared as follows:-

| Particulars | Amount |

| Net Income | xxx |

| ADD | |

| 1. Depreciation on Fixed Assets | xxx |

| 2. Amortization of Intangible Assets | xxx |

| 3. Amortisation of Loss on Sale of Investments | xxx |

| 4. Amortisation of Loss on sale of Fixed Assets | xxx |

| 5. Losses from Other Non-Operating Incomes | xxx |

| 6. Tax Provision (Created out of Current Profits) | xxx |

| 7. Proposed Dividend | xxx |

| 8. Transfer to Reserve | xxx |

| (LESS) | |

| 1. Deferred credit | xxx |

| 2. Profit on Sale of Investments | xxx |

| 3. Profit on Sale of Fixed Assets | xxx |

| 4. Any written back Reserve & Provision | xxx |

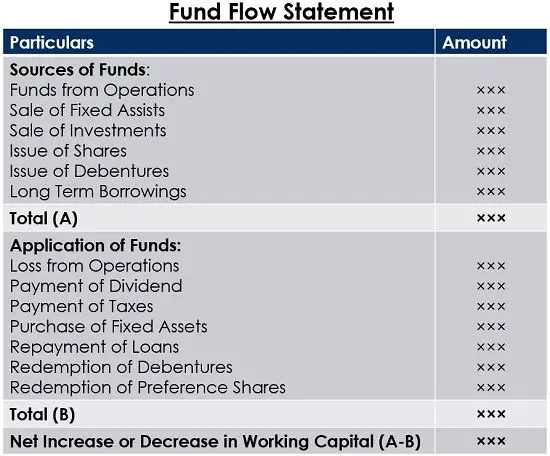

Step III: Preparation of Funds Flow Statement

While preparing the Funds Flow Statement, the Sources and Uses of Funds are to be disclosed clearly so as to highlight the Sources from where the Funds have been generated the Uses to which these Funds have been applied. This Statement is also sometimes referred to as the Sources and Applications of Funds Statement or Statement of Changes in Financial Position.

Sources of Funds

Items to be shown under the head Sources of Funds are as follows:-

- Issue of Shares and Debentures for Cash: – The total amount received from the Issue of Shares or Debentures is to shown under this head. But, the Issue of bonus Shares or Conversion of Debentures into Equity Shares or Shares issued to vendors shall not be shown here as there is no inflow of Cash

- Long Term Loans: The Amount received on raising Long Term Loans is shown under this head. Short Term Loans are not to be shown here as their treatment has already been done while preparing the Statement of Changes in Working Capital.

- Sale of Investments and other Fixed Assets: The Total Amount received on the sale of Investments and other Fixed Assets is to be shown under this head.

- Funds from Operations: The Funds generated from Operations as computed in Step II are also required to be shown here.

- Decrease in Working Capital: This would be the Balancing Figure of the Statement and will come from change in Working Capital Statement

Application of Funds flow statement

Items to be shown under Application of Funds are as follows:-

- Purchase of Fixed Assets and Investments: The Cash Payment made for purchase of Fixed Assets and Investments is an application of Funds. But if the purchase if made by issue of shares or debentures, such a transaction will not constitute application of funds. Similarly, if the purchases are on credit, these will not constitute fund applications.

- Redemption of Debentures, Preference Shares and Repayment of Loan:- Payment made including Premium (less: Discount) is to be taken as fund application

- Payment of Dividend & Tax: Payment of Dividend and Tax are to be taken as applications of fund if the provisions are excluded from Current Liabilities and Current Provisions are added back to profit to determine the “Funds from Operations”

- Increase in Working Capital: This would be the Balancing Figure of the Statement and will come from change in Working Capital Statement

As explained above, the Funds Flow Statement summarizes for a particular period the resources made available to finance the activities of an enterprise and the uses to which such resources have been put.

Which of the following statements is true when it comes to taking a business online?

can you give the answer to this question! Which of the following statements is true when it comes to taking a business online?

- A Stick to what you are doing and don’t make changes

- B The same content works across online and offline platforms

- C Use analytics to make informed decisions

- D Use analytics to track your customers across the internet

Also Check : Difference Between Cash Flow and Funds Flow Analysis