What is profit Volume ratio (P/V ratio)?

The profit-volume ratio is a measure of the relationship between sales and contribution. It is often expressed in percentage.

This ratio measures the contribution per rupee for sales. The profit-volume ratio measures the change in profit as a result of changes in volume.

profit Volume ratio is also called the ‘contribution ratio’ or ‘marginal ratio’, expresses the relation of contribution to sales.

In summary, the profit volume ratio (P/V ratio) is a percentage that represents the relationship between profit and sales volume. It provides insights into the contribution of each unit sold towards covering fixed costs and generating profit. By analyzing the P/V ratio, businesses can make informed decisions regarding pricing, cost control, and sales volume targets to enhance profitability.

Why is Profit Volume ratio important?

The profit-volume ratio has many advantages. It can be used to determine the profitability of each product or group of products separately so that one can examine the need for continued production. It can also be used for determining the profitability of each production Centre, process, or operation.

It is one of the important ratios for computing profitability as it indicates contribution earned with respect to sales.

The PV ratio or P/V ratio is arrived at by using the following pv ratio formula.

PV Ratio Formula or Profit Volume Ratio Formula

P/V ratio =contribution x100/sales (*Contribution means the difference between the sale price and variable cost).

Her contribution is multiplied by 100 to arrive at the percentage.

For example, the sale price of a cup is Rs.80, its variable cost is Rs.60, then the Profit Volume ratio is (80-60)× 100/80=20×100÷80=25%. .

From the above example, we may observe that the variable cost is the important cost in deciding profitability when fixed costs are constant.

When the PV ratio is high it indicates the high profit margin. A low PV ratio indicates a low profit margin. In the cases of low margin, the company has to either increase the selling price to improve the PV ratio or increase the sales turnover to earn satisfactory profit in the business. The situation of a high PV ratio is called a profitable situation.

The following illustration further clarifies how to calculate the profit volume ratio using pv ratio formula.

P/V Ratio = Contribution/Sales

Since Contribution = Sales – Variable Cost = Fixed Cost + Profit, P/V ratio can also be expressed as:

P/V Ratio = Sales – Variable cost/Sales i.e. S – V/S

or, P/V Ratio = Fixed Cost + Profit/Sales i.e. F + P/S

or, P/V Ratio = Change in profit or Contribution/Change in Sales

This ratio can also be shown in the form of percentage by multiplying by 100. Thus, if the selling price of a product is Rs. 20 and the variable cost is Rs. 15 per unit, then

P/V Ratio = 20 – 15/20 × 100 = 5/20 × 100 = 25%

The P/V ratio, which establishes the relationship between contribution and sales, is of vital importance for studying the profitability of operations of a business. It reveals the effect on profit of changes in the volume.

In the above example, for every Rs. 100 sales, a Contribution of Rs. 25 is made towards meeting the fixed expenses and then the profit comparison for P/V ratios can be made to find out which product, department or process is more profitable. Higher the P/V ratio, more will be the profit and lower the P/V ratio, lesser will be the profit. Thus, every management aims at increasing the P/V ratio.

Uses of P/V Ratio:

(i) It helps in the determination of Break-even-point [BEP = Fixed cost ÷ P/V ratio]

(ii) It helps in the determination of profit at any volume of sales

[Sales x P/V ratio = Contribution, Profit = Contribution – Fixed Cost]

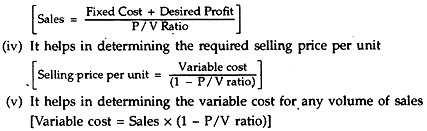

(iii) It helps in the determination of sales to earn a desired amount of profit

(vi) It helps in determining margin of safety [Margin of safety = Profit ÷ P/V ratio]

You can also check: Advantages and Disadvantages of Gueridon

Numerical of Profit volume ratio formula

Keywords : profit volume ratio formula,

mail order pharmacy india https://indiaph24.store/# top 10 online pharmacy in india

reputable indian online pharmacy

http://indiaph24.store/# reputable indian online pharmacy

http://indiaph24.store/# reputable indian online pharmacy

buy prescription drugs from india http://indiaph24.store/# india pharmacy

buy prescription drugs from india

reputable mexican pharmacies online: mexico pharmacy – medication from mexico pharmacy

mexico drug stores pharmacies [url=http://mexicoph24.life/#]mexican pharmacy[/url] purple pharmacy mexico price list