‘Profitability Index’

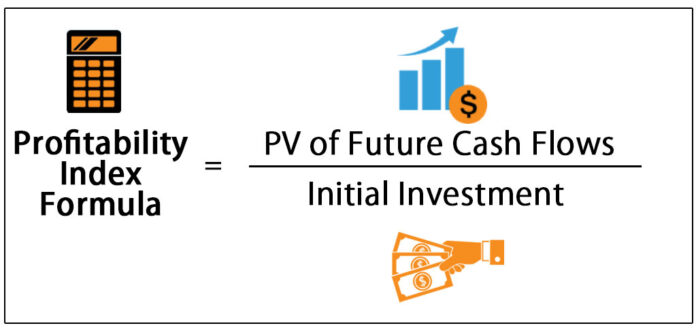

The profitability index is an index that attempts to identify the relationship between the costs and benefits of a proposed project through the use of a ratio calculated as:

Profitability index

A profitability index of 1.0 is logically the lowest acceptable measure on the index, as any value lower than 1.0 would indicate that the project’s present value (PV) is less than the initial investment. As the value of the profitability index increases, so does the financial attractiveness of the proposed project.

Profitability index is an appraisal technique applied to potential capital outlays. The technique divides the projected capital inflow by the projected capital outflow to determine the profitability of a project. As indicated by the formula above, the profitability index uses the present value of future cash flows and the initial investment to represent the aforementioned variables.

When using the profitability index to compare the desirability of projects, it’s important to consider that the technique disregards project size. Therefore, projects with larger cash inflows may result in lower profitability index calculations because their profit margins are not as high.